maryland local earned income tax credit

However Maryland law has a unique quirk providing that if the revenue impact of an IRC amendment for a tax year that begins in the calendar year in which the amendment is enacted. Maryland is a rolling conformity state that generally conforms to federal income tax laws except for instances when the Maryland legislature has enacted decoupling legislation.

Earned Income Tax Credit Now Available To Seniors Without Dependents

Additional qualifications may be required.

. There is no tuition fee for the H. Income Tax Course. However you may be required to purchase course materials.

Enrollment in or completion of the HR Block Income Tax Course is neither an offer nor a guarantee of employment.

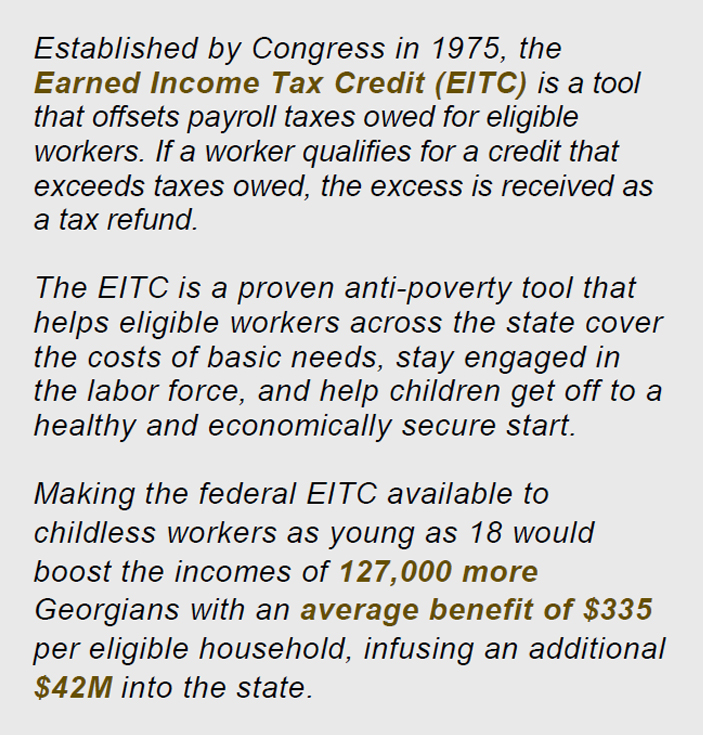

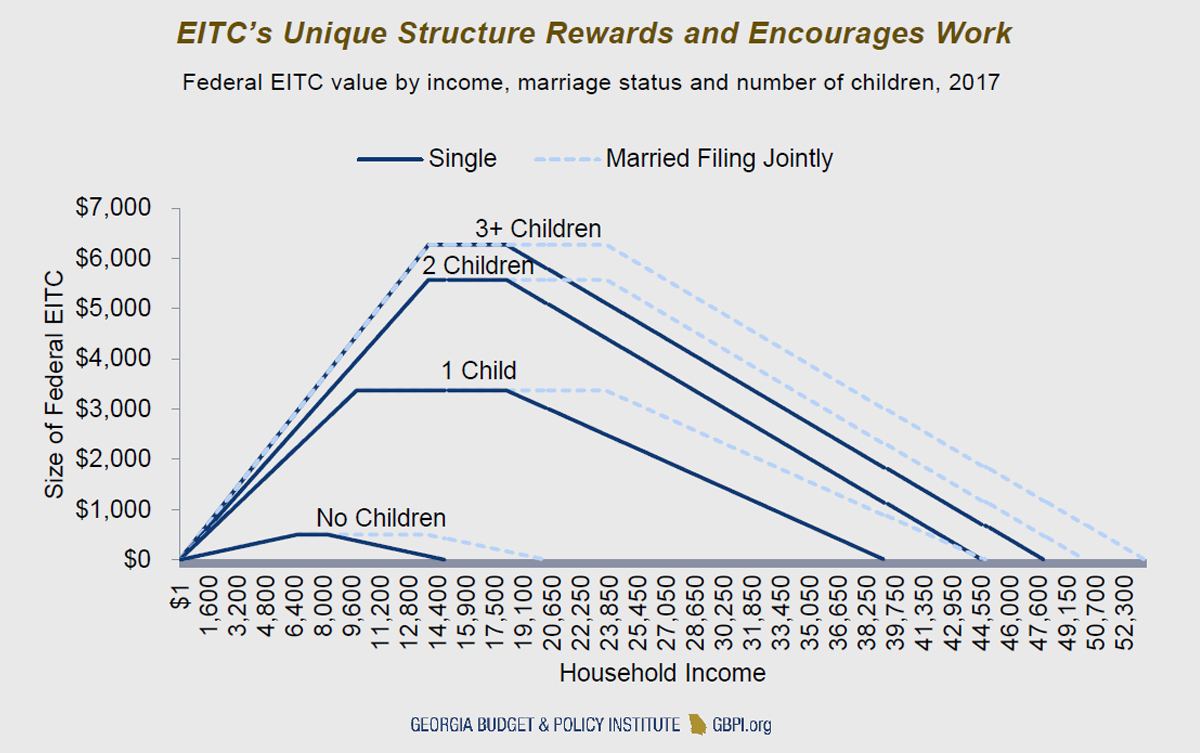

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Irs Child Tax Credit Payments Start July 15

Eligible Taxpayers Can Claim Earned Income Tax Credit In These States

Explained How To Get Up To 3 600 Per Child In Tax Credit The Oakland Press

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Child Tax Credit What We Do Community Advocates

Child Tax Credit Schedule 8812 H R Block

How Do State Earned Income Tax Credits Work Tax Policy Center

Free Tax Prep For Low To Moderate Income Marylanders Wtop News

Earned Income Credit H R Block

Summary Of Eitc Letters Notices H R Block

See The Eic Earned Income Credit Table Online Taxes Earnings Tax Refund